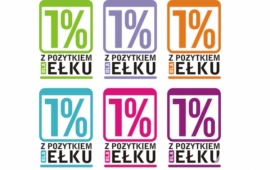

Last week to support the Ełek Public Benefit Organization "1% with benefit for Elk"

25 May 2020, Author: Paweł Butwiłowski, Maciej Juchniewicz

City self-government campaign "1% with benefit for

Ełku" aims to additionalsupport for residents

The elevation of the organization of public benefit.

Who can pass 1% tax:

- Taxpayers personal income tax (including m.in. obtaining income from the sale of securities for consideration);

- taxable persons taxed on a lump sum on the income recorded;

- taxable persons carrying on an economic activity and benefiting from a linear 19% rate of tax.

Ełcki Public Benefit Organisations (OPP) entitled to a 1% tax write-off for 2019:

Note! The deadline for filing tax returns for 2019 has been extended until the end of May 2020.

The program "PITax.pl Easy taxes" at the link:

https://www.pitax.pl/rozlicz/urzad-miasta-w-elku/

Free PIT program provides the company "PITax.pl Easy Taxes" as part of the project "Support locally" run by the Institute for Support of Ngos.

The program "PITax.pl Easy taxes" at the link:

https://www.pitax.pl/rozlicz/urzad-miasta-w-elku/

Free PIT program provides the company "PITax.pl Easy Taxes" as part of the project "Support locally" run by the Institute for Support of Ngos.

Photo gallery

News categories:

- News (3133) »

- Events happening in Ełk (1205) »

- Education (384) »

- Videos from the series Safe Elk (9) »

- Videos of the series happens in ełk (29) »

- Physical Culture Development Fund (1) »

- Investments (186) »

- Invest - aktualności (115) »

- Invest - projekty inwestycyjne (24) »

- Invest - tereny inwestycyjne (2) »

- About Coronavirus (97) »

- Culture (510) »

- In memory (9) »

- White Lily Award Winners (12) »

- NATO in Masuria (11) »

- Awards and distinctions for Ełk (25) »

- Awards and scholarships (34) »

- Deliberations of the Elk City Council (38) »

- Ngos (304) »

- Aid to Ukraine (54) »

- Improving the energy efficiency of buildings (1) »

- Clean Air Priority Programme (2) »

- Government Local Government Roads Fund (6) »

- Government Local Investment Fund (10) »

- Government Program for the Reconstruction of Monuments (2) »

- Revitalization (51) »

- Entertainment (670) »

- Anniversaries and celebrations (140) »

- Sport (347) »

- Obstructification and changes in traffic organisation (62) »

- Obstructification and change of traffic organisation (62) »

- International cooperation (16) »

- Adopt an Ełk dog (4) »

- Tasks carried out from the state budget or from state special purpose funds (1) »

- Green transport (2) »

Calendar

Investment offers

Photo galleries

Videos

News from the Town Hall

Tourism

Economy

Virtual walk

Webcams online

Companies and institutions

EU projects

Investments

EU projects archives

Report an event

Rate the work of the City Hall

Join us on Facebook

E-Cards

E-Books

Revitalization

Non-governmental organizations